TLDR: Retaining Bank Customers with AI Agents

Challenges to Retention: Rising competition and expectations.

AI Agents Solution: Personalised, proactive customer engagement.

How It Helps:

- Inactive Accounts: Reconnect dormant users easily.

- Upsell & Cross-Sell: Recommend relevant financial products.

- Customer Engagement: Automate personalised communication.

- Operations Automation: Streamline routine banking tasks.

- Customer Support: Offer instant, 24/7 help.

Customer retention is harder than ever—despite all the investment in digital transformation and automation. Banks are facing:

- Inconsistent customer experiences across digital and offline channels, leading to fragmented engagement.

- Data silos make it nearly impossible to get a unified view of customer behaviour and needs.

- Ineffective personalisation occurs when manual efforts fall short in delivering relevant, real-time interactions.

No strategy, just confusion —when outdated systems fail to turn data into meaningful customer insights.

But the real problem? Most banks are spending their resources on finding the right CRM or Automation solution, instead of getting AI agents for retaining customers!

We’ve curated a guide on how AI agents for retaining customers can transform your customer retention strategy and keep your bank ahead of the competition.

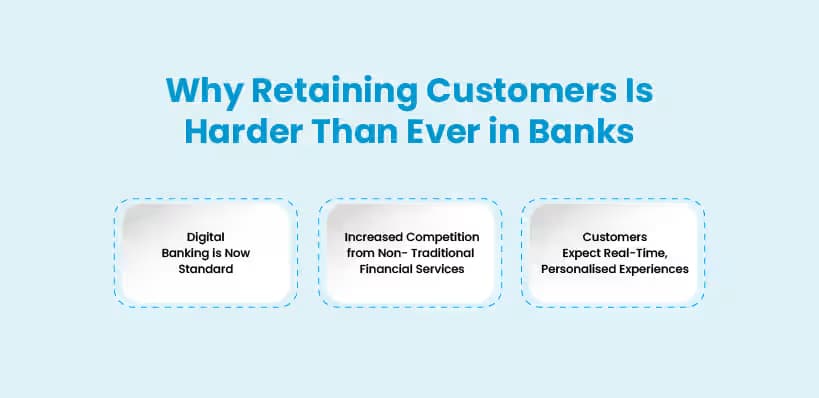

Why Retaining Customers Is Harder Than Ever in Banks

The banking sector is experiencing significant shifts that are making customer retention more challenging for institutions. Digital transformation is well underway, but several recent industry changes are putting new pressure on banks to innovate their retention strategies.

Here’s why retention is getting harder

1. Digital Banking is Now Standard, Not an Advantage

Over the last decade, digital banking has transitioned from a competitive edge to a baseline expectation. Customers now expect to perform banking functions seamlessly on:

- mobile apps

- Websites

- other digital platforms

Digital transformation is still an ongoing process, but it needs to move beyond just offering mobile apps or online services. It’s about delivering meaningful, personalised interactions at every touchpoint.

2. Increased Competition from Non-Traditional Financial Services

Fintechs, neobanks, and challenger banks are entering the market with more customer-centric, flexible, and often digital-first services. Banks now face pressure not only from other established institutions but from innovative disruptors in the market. This growing competition has made it even more difficult for traditional banks to retain customers.

3. Customers Expect Real-Time, Personalised Experiences

Customers today expect banks to know them. They want their bank to anticipate their needs, make personalised product recommendations, and communicate in real-time across multiple channels. Traditional methods of customer engagement—like email blasts or generic mobile notifications—no longer suffice.

With open banking and increasing access to customer data, competitors can now offer more targeted services, increasing the risk of churn for banks that don’t personalise their engagement.

It boils down to one thing: Customer expectations have evolved faster than most banks have been able to adapt, and now expect instant, personalised, and frictionless experiences.—whether they’re interacting with your bank online, in an app, or in person. Digital transformation alone isn’t enough to meet these new expectations.

And here’s where the following significant change comes in: AI agents for retaining customers.

Role of AI Agents in Retaining Customers

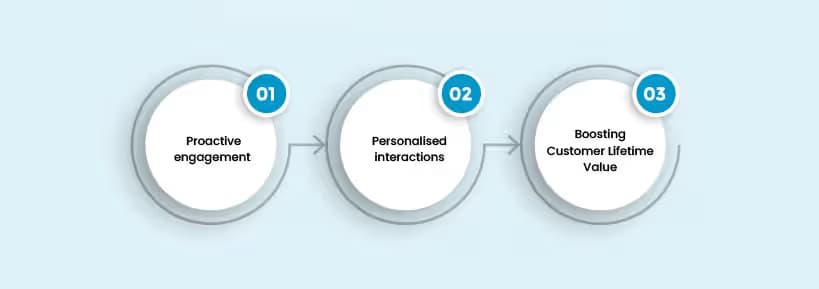

While digital banking was the evolution of accessibility, the AI customer retention tool is the evolution of intelligence. AI‐powered retention agents are transforming how banks engage with customers, turning every interaction into a chance to strengthen customer loyalty and boost customer lifetime value (LTV), ultimately retaining customers. Here’s how they benefit:

- Proactive Engagement: AI agents automatically engage with customers at key moments, driving personalised experiences across channels.

- Personalised Interactions: AI uses real-time data to tailor interactions, offering relevant recommendations that enhance customer loyalty.

- Boosting Customer Lifetime Value: By strengthening customer relationships, AI agents help increase customer lifetime value (LTV).

How to Implement AI Agents for Customer Retention

There are so many functions that an AI agent for personalised customer retention strategies can perform. So, let’s take a few key areas of banking operations which are very crucial and cause customer churn:

1. Inactive Account Activation

Problem: Inactive accounts lead to lost revenue opportunities and increased churn.

How AI Agents Help:

- Identify dormant accounts based on inactivity signals, such as no recent transactions or logins.

- Trigger personalised re-engagement campaigns via whatsapp, email, SMS, or app notifications to encourage customers to return.

- Offer exclusive incentives or reminders about unused features to bring customers back.

2. Upsell and Cross-Sell

Problem: Banks miss out on upselling and cross-selling opportunities with existing customers.

How AI Agents Help:

- Analyse customer data (transaction history, financial behaviour, etc.) to identify upsell and cross-sell opportunities.

- Automatically suggest relevant products such as loans, credit cards, or savings plans based on the customer’s needs and financial activity.

- Deliver personalised product recommendations at key moments through AI-powered interactions across various channels (email, mobile, app).

3. Customer Engagement

Problem: Maintaining continuous engagement with customers is difficult, especially when they have many service options.

How AI Agents Help:

- Send personalised engagement messages such as loyalty rewards, special offers, or exclusive deals, based on customer behaviour and preferences.

- Automate proactive engagement by using customer data to send relevant updates (e.g., account benefits, reminders for using services) in real time.

- Ensure consistent interaction through multiple channels (mobile, email, SMS) to keep customers actively engaged and loyal to the brand.

4. Customer Operations Automation

Problem: Routine customer operations take time and resources, leading to delays in response and friction in customer service.

How AI Agents Help:

- Automate routine tasks such as balance inquiries, account updates, payment tracking, and more.

- Provide instant responses to common queries, allowing customers to resolve issues without waiting for human agents.

- Free up human agents for more complex issues by handling repetitive tasks, leading to higher operational efficiency and faster service.

5. Customer Support

Problem: Slow support response times and inconsistent service can lead to poor customer experiences.

How AI Agents Help:

- Offer 24/7 support for basic queries, ensuring customers get help at any time of day.

- Escalate complex issues seamlessly to human agents, ensuring customers don’t feel frustrated with long waiting times or a lack of support.

- Monitor customer sentiment during interactions and provide immediate interventions to resolve potential issues, improving overall customer satisfaction.

TechMonk: Build AI Agents to Retain Customers in Your Bank

TechMonk is an AI agent-powered platform that helps you automate and improve every stage of customer engagement. It takes care of everything from acquisition to retention. What makes TechMonk special? It offers a complete marketing toolkit in one place. You get customer intelligence, segmentation, personalisation, and AI-powered campaigns all working together to make your job easier.

You use intelligent, task-oriented AI agents that can think and act on their own. These agents can see, decide, and act across different workflows. Each one learns from customer behaviour and analyses results to perform tasks like follow-ups, raising tickets, or even closing sales. Together, they turn TechMonk into a complete AI capital engine for your business.

These are specially designed for banking institutions:

- Customer Support: Improve customer satisfaction with AI agent-driven support. TechMonk’s AI agents provide instant help and solve routine questions quickly. They automatically create support tickets and hand over complex issues to human agents when required. This ensures smooth and fast support for every customer.

- Customer Engagement: Build stronger loyalty with hyper-personalised engagement powered by AI agents. They share relevant content and create interactive experiences across multiple channels. This helps you form long-term relationships and build brand loyalty that lasts.

- Inactive Account Activation:Bring inactive accounts back to life with AI agent-driven strategies. TechMonk’s segmentation tools identify inactive customers based on their behaviour. You can then launch targeted re-engagement campaigns for them. The AI agents follow up, offer personalised deals, and send proactive nudges to win them back.

- Upsell and Cross Sell: Increase your revenue with AI agent-powered upsell and cross-sell opportunities. TechMonk’s AI agents study customer behaviour and recommend the right products at the right time. This helps you get higher conversions and boosts customer lifetime value.

- Customer Operations: Transform your daily operations with AI agent automation. From onboarding to transaction management, TechMonk’s AI agents handle routine tasks with ease. They reduce manual effort and help your team work more efficiently.

Create AI Agents in 3 Easy Steps

- Tools Library : Choose from pre-built tools or create your own. These tools give your AI agents everything they need to perform any task in your workflow.

- Agents Library : Pick from ready-to-use AI agents or build custom ones. They can use your tools or the pre-built ones available in the library.

- Agent Flow :Automate your workflows easily. Assign tasks to the right AI agents and ensure everything gets done on time. TechMonk’s orchestrator manages task delegation smoothly for you.

AgentMonk: The AI Agent Platform

With AgentMonk, TechMonk’s AI agent platform, you can see exactly how your AI agents work. You can train them to perform better using tools that track, refine, and improve every interaction. This ensures your agents always deliver the best results.

- Input & Output Guardrails: Set clear input and output guardrails to make sure your AI agents give accurate answers. This keeps your data safe and prevents misuse or wrong responses.

- Testing Automation: Check AI agent responses automatically with the LLM Judge. This ensures your agents always give correct and relevant answers. Automation reduces manual checks and keeps your agents sharp.

- Observability of Workflows: Stay in control with real-time visibility into all workflows. You can see issues as they happen and fix them right away. This keeps customer journeys smooth and consistent.

- Traceability of Conversations: Track every conversation your AI agents have with customers. You can see the full flow and understand how each decision was made. This keeps communication transparent and easy to improve.

- Tracking AI Agent Performance: Monitor key metrics like response time, accuracy, and latency. AgentMonk gives you tools to fine-tune your agents so they perform better and respond faster. This leads to happier customers.

Why TechMonk’s AI Agents Stand Out

- Customer Intelligence Platform : Build a full 360° view of your customers. Combine their profiles, financial behaviour, and engagement history to deliver smarter and more personal service.

- AI-Driven Campaigns : Launch targeted campaigns with ease. Personalise offers for the right segments using filters like age, location, and behaviour to improve engagement.

- Journey Builder :Design smooth and personalised customer journeys. AI helps you engage different customer groups and create experiences that feel natural and relevant.

Supercharge Your Customer Retention Strategy with TechMonk’s AI Agents

Conclusion

AI agents for retaining customers offer a powerful solution to drive better engagement, reduce churn, and ultimately increase customer lifetime value. By implementing AI agents, you can automate routine tasks, personalise every customer interaction, and build stronger relationships with your customers, all while maintaining high operational efficiency.

As a Digital Transformation Officer, CRM Manager, or Marketing Head, this is your opportunity to take action and lead the charge in building more personalised, effective customer retention strategies.

FAQs

What is an AI agent for digital customer acquisition?

How does an AI agent help acquire customers online?

Which industries can benefit most from AI-driven digital customer acquisition?

How does AI improve digital customer conversion rates?